I ways thought that there would be a a cauldron of gold at the end of the rainbow when I retired . If I am lucky . Funny while our media focuses on the "bathroom". There has been serious news that could effect everyone in the United States who have not yet reached 62 . (1)>>Considering our current American economic system . A. Raising the retirement age. What if, as happened to many seniors when the recession hit, you are laid off? Involuntary retirement because getting another job when you are over 60 is about zero possibility. So you take a job at $7.50 an hour then lose your home and starve. Now argument is , Sorry but even though they paid into the system, it does not seem right that someone earning a million a year from stocks and bonds should also be getting SS. Maybe pay them back what they paid in then it would stop. SS was supposed to help poor people when they got too old to be hired not everyone. Again our government is gambling it's citizens lives away.

American Progress Reported that :

As the debate around Social Security continues on Capitol Hill and evidence of the widening gap in life expectancy between the richest and poorest Americans continues to mount, the Center for American Progress urges that now is the time to expand and strengthen Social Security, not cut it. Not only would raising the retirement age reduce benefits for all future beneficiaries, lower-income workers would bear the brunt of these cuts. A new CAP column highlights how the growing life expectancy gap is shrinking lifetime Social Security benefits for lower-income workers.

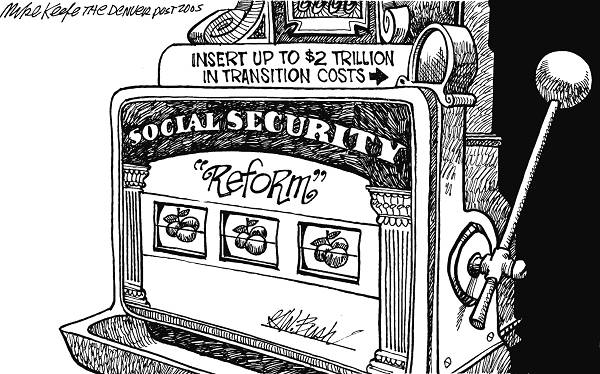

Striking as it seems , we have told , that the whole argument is that Social Security will run out of money in the year 2035. (2)>>Are we being fed by the Fed some sort of Kool aide ? The Washington D.C. broken government system wants to raise the retirement age to 70. If you don't think nothing is fishy about it . I am assuming that I will live to be 70 , but people I've been noticing don't make it , my belief is as soon as some American tax payer passes on , what ever YOU paid into Social Security, that money is sized by Uncle Sam , recycled . My bitter feelings towards this , even if these government idiots do raise the age of retirement , they are robbing YOU of something precious, that is, living longer in solitude . Honestly I am against raising the age of retirement. One myth here is people are living longer, so they would retire much later . That's is not true . That's all based on circumstances . The widening life expectancy gap in the United States has significant consequences when it comes to Social Security. Since the wealthiest tend to live longer, lower-income earners, on average, receive much less in Social Security benefits over their lifetimes. Raising the retirement age—to 70 years, for example, as some conservatives have proposed—would shorten the total period over which workers—particularly lower-income workers—can access the benefits they have earned. And raising the early retirement age from 62 would move critical retirement benefits out of reach for older workers who need to retire in their early 60s for health, family, or economic reasons. (3)>>Beginning in 2015, and every year after that, payroll tax revenue will be insufficient to pay full benefits. This was known in 1983 when the Social Security "fix" was enacted. The plan was to draw down the large reserve that is supposed to be in the trust fund and use that money to supplement payroll tax revenue so that full benefits could be paid until 2037. But that money has already been spent, so the government will have to come up with the money again to repay the $2.54 trillion that it embezzled. This might be manageable in the early years, when the difference between benefit costs and payroll tax revenue is

2020, the Social Security deficit will have grown to $101.4 billion. Five years later, in 2025, the Social Security shortfall will be $274.6 billion. In 2035, the government would have to come up with an astronomical $621.9 billion in order to pay full Social Security benefits. When President Obama first saw these numbers, he must have almost gone into a state of shock. His predecessors left him with a lot of problems that can plainly be seen by the public - two wars, a collapsed economy, and a gigantic deficit and debt. But the embezzlement of the Social Security trust fund money was done without public knowledge, and it is doubtful that Obama knew anything about it prior to becoming a United States Senator, and he may have not known about it until he entered the White House. President Obama cannot just kick the can farther down the road as his four predecessors have done. He must find a way to raise the money to repay the government's debt to Social Security, or cut Social Security benefits so the money will not have to be repaid. Looking at the true state of affairs, instead of the (4)>>manufactured statistics we have been fed, it seems that unless our economic condition in coming decades parallels that of the Great Depression, the Social Security system is not in danger. (In fact the very people who are predicting the failure of the Social Security Trust Fund in the coming decades are predicting a financial boom during these same decades.[2]) The wildly pessimistic projections are based on assumptions that the economy will grow an average of 1.8 percent per year for the next 75 years — less than half the rate of the previous 75 years. Even in the 1930s — the decade of the Great Depression — the growth rate was faster than that! If the economic situation really does match the performance upon which the doomsayers' prophecies rest, we will have a lot more to worry about than Social Security.

For Further information . Please go to this URL. http://www.hermes-press.com/sss1.htm

NOTES AND COMMENTS:

(1)>>Considering our current American economic system . The National Committee to Preserve Social Security and Medicare Foundation has released a new poll on American's views on Social Security, proposals for raising the retirement age, and cutting benefits. The national telephone poll, conducted June 24-June 30th , 2010. By the University of New Hampshire Survey Center, shows a growing disconnect between the average American's economic priorities and those being debated in Washington. Since 2010, the OASI program has taken in less money from payroll tax revenues and the taxation of benefits than it pays out in benefits, generating cash-flow deficits. The 2014 cash-flow deficit was $39 billion. Over the next 10 years, the OASI program’s cumulative cash-flow deficit will amount to $840 billion, according to the trustees’ intermediate assumptions. For as long as the federal government is running deficits in excess of Social Security’s cash-flow deficits, we can assume that this $840 billion shortfall will be matched dollar for dollar by an increase in the public debt.Social Security’s cash-flow deficits add to the public debt because, in order to pay full Social Security benefits, the Treasury Department has to raise cash in excess of what it receives from the payroll tax and the taxation of benefits. Cash-flow deficits mean that the Treasury can no longer pay all Social Security benefits from the program’s tax income alone. Instead, Treasury must produce additional cash from taxes or borrowing. With annual federal deficits in excess of Social Security’s cash-flow deficit, the OASI program is already adding to the deficit. (2)>>Are we being fed by the Fed some sort of Kool aide ? Social Security can't be heading for insolvency , here is why . As complex as the calculations can be, the idea behind Social Security benefits is pretty straightforward.Benefits are based on average monthly earnings for your 35 highest-paid years. Once eligible, you're paid a certain amount for each dollar of your average earnings:For average monthly earnings up to $749, you receive $0.90 in benefits for every dollar of average earnings.From $749 to $4,517, you receive an additional $0.32 for every extra dollar.Above $4,517, you receive $0.15 more for every additional dollar.Add up these three amounts and you have the base amount for your total monthly benefit. This SHOULD MAKE EVERYONE ANGRY . The Social Security Trust Fund should currently have $2.5 trillion in surplus. Social Security has been running large surpluses ever since the enactment of the 1983 payroll tax hike, and was projected to continue running surpluses until at least 2016. Instead, reports show that the cost of Social Security benefits will exceed payroll tax revenue by approximately $29 billion this year, because of the severe recession which has reduced payroll tax revenue at the very time that many unemployed Americans have been forced to retire early. What it all boils down to is that, in order to pay full benefits this year, Social Security will have to come up with an extra $29 billion to supplement the inadequate payroll tax revenue. Where will that money come from? It will have to come from increased taxes or from borrowed money. "Wait a minute!" some readers will say. Hasn't Social Security been receiving surplus revenue ever since the 1983 payroll tax hike? Isn't there supposed to be approximately $2.5 trillion in the Social Security trust fund? The answer to both questions is yes. But there is a problem. Every dollar of that surplus Social Security revenue has already been spent by the government. Much of it went to fund wars in Afghanistan and Iraq. The rest has been spent on other government programs. (3)>>Beginning in 2015. In October 2015, HR 1314, also known as the Bipartisan Budget Act of 2015, was passed by Congress. That legislative bill called for some modifications to the Social Security program which are to take effect on 1 May 2016. As usual some unscrupulous finance-related businesses seized upon those modifications to scare gullible readers into signing up for hefty financial newsletter subscriptions in order to protect themselves from Congress' supposed "hidden radical reform that threatens the financial security of as many as 21.3 million Americans."In fact, the pending changes are relatively minor: they do not take away any existing benefits or alter core Social Security benefits or payment levels, they are not "hidden" or "radical," and they do not "threaten the financial security" of millions of Americans. The coming changes will alter or eliminate a fewstrategies used by some people to maximize their Social Security benefits, however, so those in a position to take advantage of them while they still exist need to know how they can be "grandfathered" in. (4)>>manufactured statistics . From what we have been able to learn, the notion that Medicare and Social Security are going broke has been a great hoax, perpetrated repeatedly since 1975 in an effort to eventually privatize the Social Security system. Whole generations of Americans have thus been purposely frightened into believing that these programs will not be there when they are needed.Because of this belief in the coming bankruptcy of the Social Security system, the American population has an attitude of placid and compliant acceptance when Medicare benefits are cut, or when the age at which Social Security benefits may be received is increased.[5]And — unless we quickly educate ourselves — there will be no murmur of protest when the government admits its "failure" to manage the Social Security system and turns it over to private corporations.

No comments:

Post a Comment