There is no Doubting in my mind that some one wants the so called "Fiscal Cliff" to happen. It Could only benefit the Democrats.

The first major test for John Boehner and the GOP caucus in the upcoming lame duck session of Congress will be confronting a newly elected and freshly emboldened Barack Hussein Obama over a series of issues that have been named by the left and its stenographers in the media as the “Fiscal Cliff.”

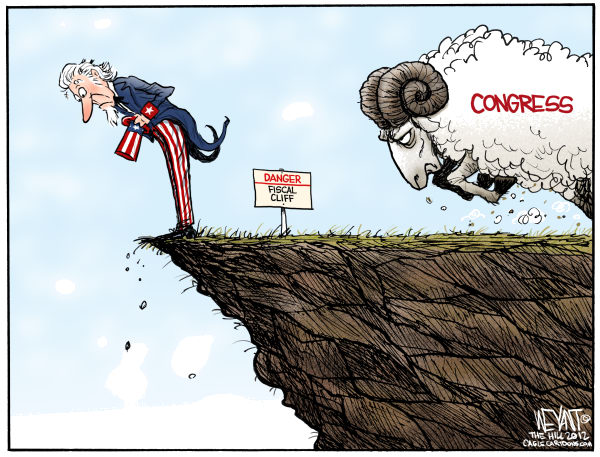

Powerful imagery, eh. Going over a cliff. But is that really what will happen. Yes , there will be a Fiscal Cliff , and here is why I am saying it. Our Nation is broke just as much as my State California . So in order to generate revenue the Lame Duck Congress will try to raise taxes on everyone .

The tax rate reductions implemented by President Bush in 2001 and 2003 will expire. This will increase taxes on Americans, or as the Democrats would say it increases the government’s income, by $281 billion. This means the average household will pay between $60 and $400 per month in additional taxes, depending upon your income. Go here for a detailed table of how the rates would change and here for what it means state by state. The states most heavily hit would be CT, NY, NJ, MA, and ** CA, in order. The payroll tax holiday enacted in 2010 will expire increasing payroll taxes by 2 points. For someone earning $50K per year this means you will lose $19 per week. All told this increases taxes by $115 billion. As preserving Social Security and Medicare are things everyone is interested in, this should go away by acclamation. Trust me folks , if Congress can cut the 16 Trillion dollar debt here is a Perfect time for Obama to stick it to us with tax increases by letting it all slide.While there is just two months to this . I am sure that it will weaken the economy to a level worse than several months ago . Here is another catch -22 of this Cliff . The Alternative Minimum Tax will expand as a the eligibility will ensnare more taxpayers. It will raise about $40 billion and will impact about 27 million taxpayers. The good news is that if your make $50K and live alone you are now considered wealthy enough to pay the same tax penalty as millionaires. Welcome to the 1%, bitches. Extended unemployment benefits will expire decreasing government outlays by $34 billion. This will undoubtedly cause some hardship. An estimated 2 million people will lose their benefits from this program. Obamacare will come into effect and begin collecting taxes, this will increase government revenues by $24 billion. The “doc fix” for Medicare will expire reducing government outlays by $14 billion. (This will be fun to watch play out as Obamacare promised a permanent “doc fix” as a way of buying the American Medical Association.) So let not fool ourselves . It's all a Governmental trick to "raise" revenues , and tax us into debt. I wonder how President 0bama will explain to his constituency the expiration of their child care credits, their increased taxes (minimum rate goes back from 10-15percent and the threshold incomes go back down their decrease in the payroll tax back up to pre-2008 levels, the earned income credits go back down) and their new taxes under ObamaCare jump. Republicans should point out that the President signed the bill, and therefore owns it. Until he proposes a rational solution to it, that will remain the law of the land. Just sit back and watch our elected leaders just walk away from this.

NOTES AND COMMENTS:

** California is an example how a failed Government raises taxes over taxes , and strangely can't balance it's budget . The current (lower) payroll tax rate will increase and extended unemployment benefits will end, cutting benefits for some 500,000 Californians. California would be hit especially hard. A study by Professor Stephen Fuller at George Mason University shows that these cuts would cost California 230,000 jobs - 135,000 from the defense industry and 95,000 from non-defense sectors.

No comments:

Post a Comment