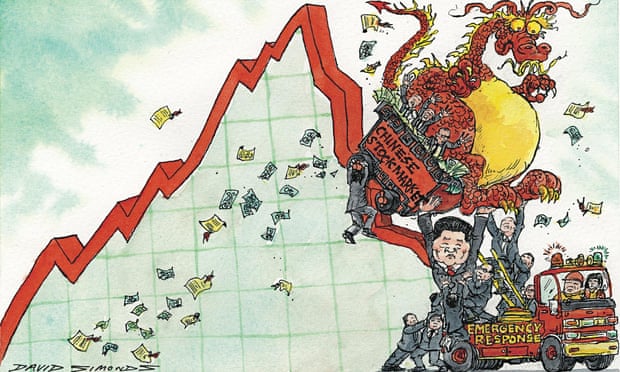

The stock market took a serious dive shortly after the Chinese government took steps to " devalue" it's own currency . When China’s currency, the (**)>> renminbi, fell against the dollar on Aug. 11, it set off a furor.Stock and commodities markets have shuddered around the world, and many traders feared that China had begun a sharp and dangerous devaluation — a salvo in a “beggar thy neighbor” currency war, in which countries would seek competitive advantage by making their goods cheaper in global markets. Trust me the Chinese government knows how to manipulate the market . It's shows with the (1)>> DOW dropping 530 points ,Stocks were clobbered Friday on Wall Street — a brutal finish to the worst week in the market in four years. The economist may think that the stock market's decline is a "bit perplexing", but it isn't. The Chinese devaluation of its currency means that U.S. imports will be more expensive there and when combined with the economic slowdown in that country, means fewer products from the U.S. will be purchased there. Two other countries have also devalued their currencies recently, so this could be a trend...we'll have to wait and see.Aside from this, if the stock market malaise goes on for an extended period of time, people who have stocks in their 401K or IRA plans will realize that their net worth has decreased as they view their assets and hold off purchasing products. It is a reactionary move which could affect the U.S. economy on an ongoing basis.The Dow Jones industrial average closed down 530 points, the ninth-biggest point decline in its history. This is market manipulation is a new form of economic Cyber war ?China did not devalue its currency sharply, and it has not embraced a currency war, at least not so far. What it has done is make very modest adjustments both in the value of its currency and in the manner in which it trades. (3)>> The whole idea is obviously to make "cheaper goods" on the market with the Made in China trademark. If you have the hard knocks on this , it's because of our American policy of exporting jobs overseas . Now Wall-Street panics . Despite the Chinese government’s ban on passing along rumors on the internet, several anonymous or unsourced posts on Sina Weibo, the popular microblogging site, point figures at one country—the US.

Chinese grand scheme of Stock Market Manipulation.

This week shows that the American stock exchange is vary vulnerable. Once the stocks and commodities takes a lesser value , so trembles the value of other shares in the market . Cheap oil is going to hurt the oil companies . That's for me the best part of the current situation . (2)>> BUT ITS UNEASY to think that China manipulated was for investors a "quick withdrawal ". Scared investors were pulling out . You have to remember that Chinese stocks are the least expensive to invest in. Given the near consensus — at least among mainstream academia — on the hurtful consequences of an undervalued yuan, most disagreement lies in deciding in what form the United States should respond or retaliate. While it's worrisome that some of the most respected economists of the mainstream have failed to assess the yuan's situation correctly, it is outright frightening that this mistake has led to the application of more bad economics. Currently, world governments are looking to enact tariffs and quotas on each other in an effort to win an "upper hand" in the global marketplace. But, as the saying goes, "the road to hell is paved with good intentions." These Keynesian — nay, mercantilist — economic policies will lead only to global disaster, and most of the damage will not be done on foreign markets, but on the markets the politicians claim to protect. So far this year, investors have withdrawn $64 billion from U.S. funds and put $158 billion of new money into international stock funds, according to check out CNN money,J.P. Morgan, Goldman Sachs, Morgan Stanley to Form Data Company Entity would consolidate efforts to clean and store reference data, helping banks save money, sources say Ahahaha, this group with the lead of the vampire squid, have a reputation of shorting stock to oblivion , they trump up stocks, get people buying them and them short the #$%$ out of them, no wonder investors are wising up and taking their business overseas –right now gold has gone up a point or two, and the euro is up. Is the Chinese stockmarket in bubble territory? That depends on what part of it one focuses on. Large-cap stocks, long depressed, are arguably more fairly priced after the rally of the past year. Many banks are still trading at valuations lower than international peers. The same cannot be said for ChiNext, a board for start-ups, especially tech firms. Its price-to-earnings ratio has reached 130, more than twice a more reasonable level for companies with strong growth stories. ChiNext is supposed to be China’s answer to Nasdaq. At the moment it looks like precisely that in 1999, just before the dotcom bubble spectacularly burst.

Ron Paul's Warning .

(4)>>Back in June , former Rep. Ron Paul says the Fed's easy money policies have left stocks and bonds are on the verge of a massive collapse."I am utterly amazed at how the Federal Reserve can play havoc with the market," Paul said on CNBC's "Futures Now" referring to Thursday's surge in stocks. The S&P 500 closed less than 1 percent off its all-time high. "I look at it as being very unstable." In Paul's eyes, "the fallacy of economic planning" has created such a "horrendous bubble" in the bond market that it's only a matter of time before the bottom falls out. And when it does, it will lead to "stock market chaos."

Well it's happening right now .

NOTES AND COMMENTS:

(***)>>The renminbi is the official currency of the People's Republic of China. The name (simplified Chinese: 人民币; traditional Chinese: 人民幣; pinyin: rénmínbì) ... YUAN. “What China has done is very astute,” said Eswar S. Prasad, the former head of the I.M.F.’s China division, and now an economist at Cornell and the Brookings Institution. “The People’s Bank of China has managed to pull off a reform that is important to them and to do it in a way that allows them to mollify domestic critics and stave off criticism from international investors.” (1)>> The Dow finished at 16,459. It fell more than 1,000 points this week alone and is down more than 10 percent from its all-time high in May — the definition of a market correction. That has not happened in four years.The Dow's decline for the day came to 3.1 percent. The Standard & Poor's 500 index, a broader gauge of the stock market, finished down 3.2 percent and closed below 2,000 for the first time since early this year. (2)>> The rout started in Asia and quickly spread to Europe, battering major markets in Germany and France. In the U.S., the selling started early and never let up. Investors ditched beaten-down oil companies, as well as Netflix, Apple and other technology darlings. Oil plunged below $40 for the first time since the financial crisis, and government bonds rallied as investors raced into hiding spots. (3)>> In hindsight it would have been better to keep the jobs here in US and send billions in aid across the world instead of cutting off our legs leaving us in a situation that there is not enough tax revenue gained to cover current spending which cannot be avoided as the US population grows while income and revenue shrink, we can't even keep up or rebuild the infrastructure at this rate. (4)>> The Randite ideology of Alan Greenspan told him that there was no danger because banks could be trusted to be honest and that they would never do anything against their own self interest.

No comments:

Post a Comment